CAPITOL HILL — President Trump could be signing massive tax cuts by midweek.

“Most Maine households will see their taxes go down,” Sen. Susan Collins, R-Maine, said Monday while announcing her support for the bill.

There are now few obstacles standing between the $1.46 trillion tax plan and final passage. Vice President Mike Pence put off a trip to the Middle East — just in case he’s needed to break a tie in the Senate.

Collins and another GOP holdout declared their support Monday. Sen. Mike Lee, R-Utah, wrote he “will proudly vote” for the tax bill saying “it will cut taxes for working Utah families.”

And the first major independent analysis found the bill would drive up taxes for only 5 percent of taxpayers next year — an improvement from previous versions.

The Tax Policy Center determined that taxpayers making between $50,000 and $90,000 dollars would save, on average, $900 dollars — or 1.6 percent of their after-tax income.

The very top earners would see a larger cut of 3.4 percent — on average, about $51,000.

Joseph Rosenberg

CBS News

Tax expert Joseph Rosenberg says one area where Republicans fell short was their promise to make the tax code simpler.

“It’s still the case that over time the tax cuts will generally get smaller and smaller,” Rosenberg told CBS News. “It’s introducing a lot of additional complexity.”

CBS News asked if Americans will be able to do taxes on a postcard.

“I think the postcard is out,” Rosenberg said.

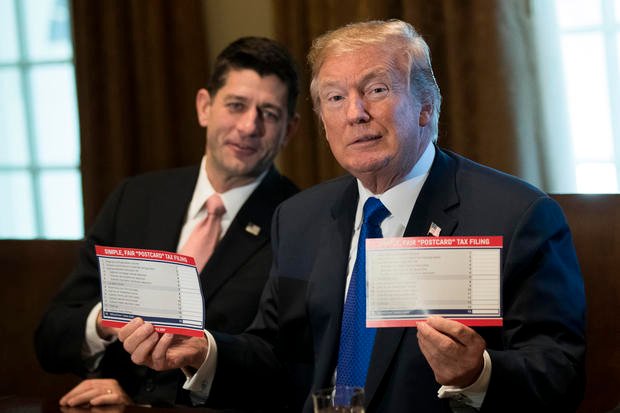

Speaker of the House Paul Ryan looks on as President Donald Trump speaks about tax reform legislation in the Cabinet Room at the White House, on Nov. 2, 2017, in Washington, D.C.

Getty

Some controversy simmered over a last minute addition — a big deduction for certain types of businesses, even if they have few or no employees.

Analysts say it would primarily benefit wealthy commercial real estate investors like Mr. Trump or Tennessee Republican Sen. Bob Corker.

“The benefits are larger the more income you have,” Rosenberg points out.

Rosenberg also says that you might benefit — but not very much — if you own an apartment that is rented out.

Corker — a holdout who came around Friday — insisted Monday he had no knowledge of the provision and GOP leaders backed him up. Democrats said either way it’s a needless giveaway to a thriving industry — even as the bill pares back the popular home mortgage deduction for individuals.

© 2017 CBS Interactive Inc. All Rights Reserved.